How Financial Stress Quietly Erodes Your Wealthspan

Persistent financial stress does not just feel bad, it reshapes decision making in ways that quietly reduce your effective Wealthspan.

Why Healthspan Determines the Length of Your Wealthspan

Your wealthspan is ultimately limited by how long you can engage with life, not how long your money lasts.

Most Clutter Isn’t a Mess. It’s Postponed Decisions.

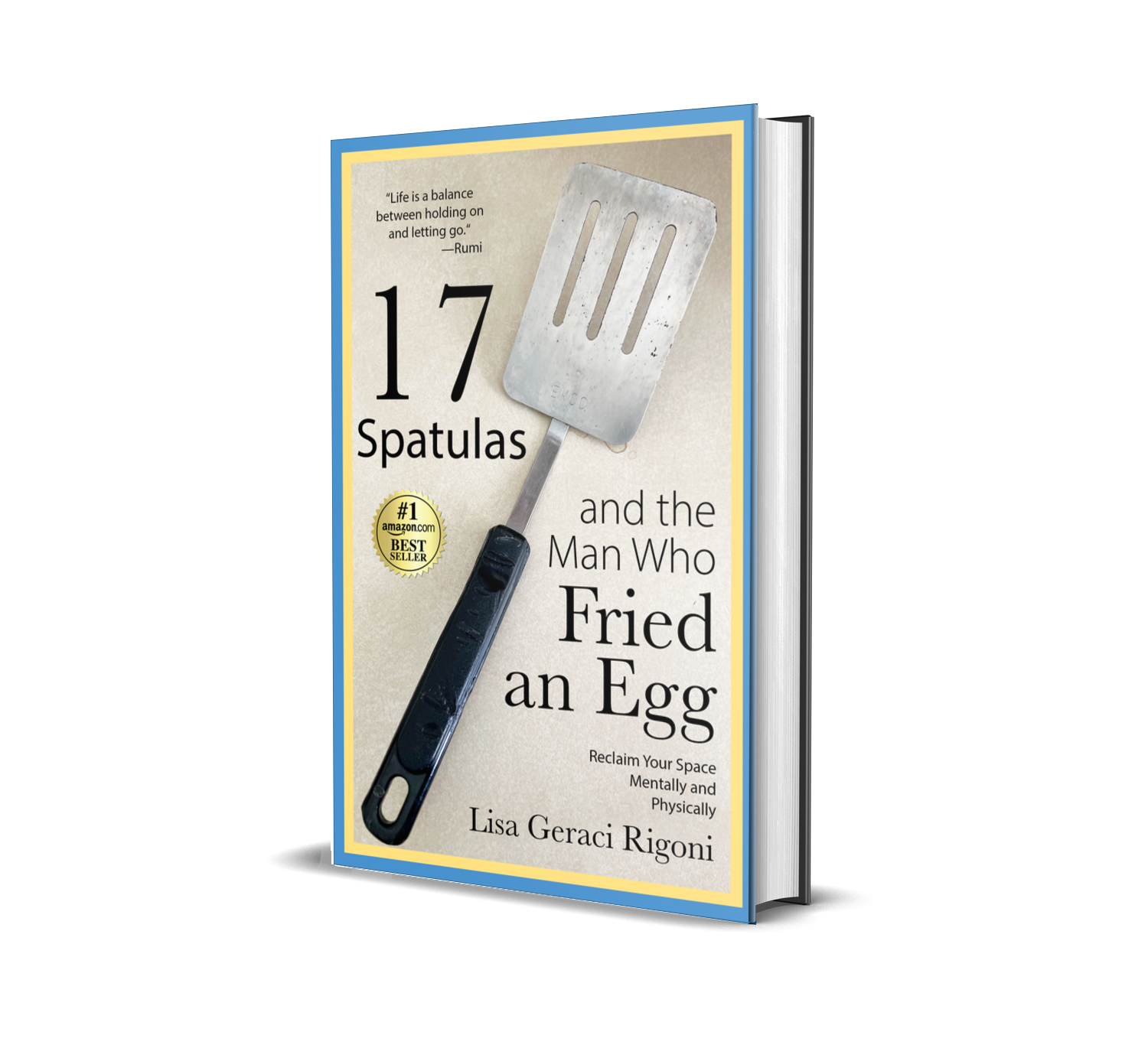

Most clutter is not a failure of discipline or organization. It is a collection of postponed decisions that quietly accumulated over time. What looks like excess is often unfinished chapters, unanswered questions, and versions of ourselves that never fully closed. Letting go is not about getting rid of things. It is about noticing what no longer belongs in this stage of life.

Aging Gracefully Is a Myth. Aging Intentionally Is Not.

Aging Gracefully Is a Myth. Aging Intentionally Is Not.

When Saving Feels Safer Than Spending: The Hidden Psychology of Retirement

After decades of saving, many retirees struggle more with mindset than math. Fear of running out of money can make spending feel risky. We guide retirees to align financial planning with purpose, reframe spending anxieties, and fund a life well-lived.

This Is Not Retirement. This Is Reinvention.

Retirement isn’t an ending, it’s reinvention.

We’re living longer, healthier lives, and the old script no longer fits. This is your chance to design what comes next with purpose, freedom, and a wealthspan built for the life you want.

Why Longevity is About Your Calendar, Not Your Bank Account

Blue Zones prove that a strong sense of purpose is the real key to a long, healthy life. Your wealth plan should be a purpose plan, creating the sustained income to guarantee your freedom.

The Unstoppable You: Why Your Brain is Your Best Investment

Your mind is your best tool for that construction. By investing in lifelong learning, you're not just preparing for the future; you're actively creating a more vibrant, meaningful life right now. It's the ultimate investment in yourself.