When Nothing Is Wrong, But Something Feels Off

The uneasy feeling may not mean you’re failing—it may mean your internal map hasn’t caught up to a new chapter yet.

You’re Not Late. You’re Early in a Longer Timeline

Feeling late is often a sign the timeline has changed. Longer lives turn endings into transitions and make flexibility more important than speed.

How Financial Stress Quietly Erodes Your Wealthspan

Persistent financial stress does not just feel bad, it reshapes decision making in ways that quietly reduce your effective Wealthspan.

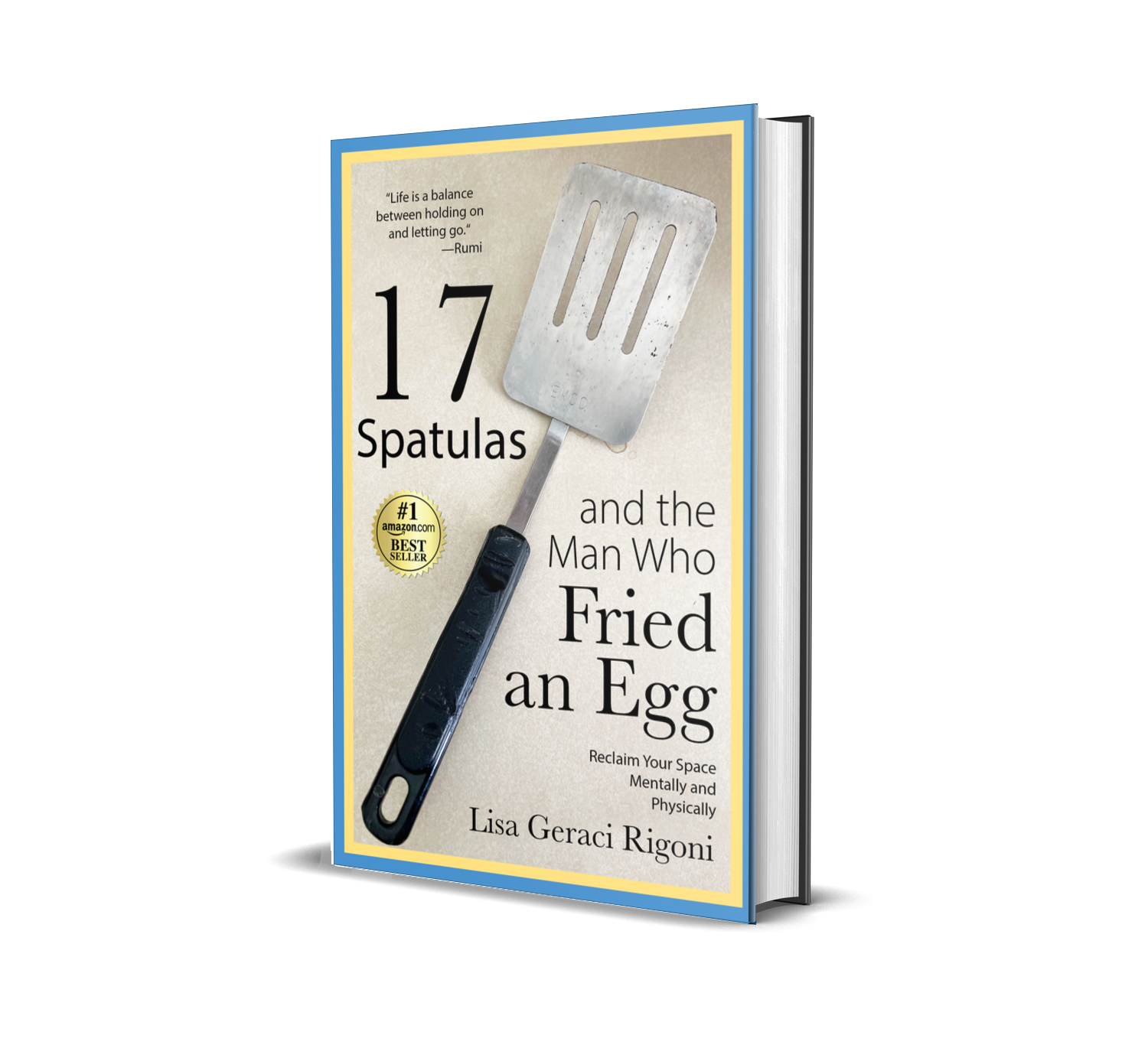

Most Clutter Isn’t a Mess. It’s Postponed Decisions.

Most clutter is not a failure of discipline or organization. It is a collection of postponed decisions that quietly accumulated over time. What looks like excess is often unfinished chapters, unanswered questions, and versions of ourselves that never fully closed. Letting go is not about getting rid of things. It is about noticing what no longer belongs in this stage of life.

Boutique Service, Fortune 500 Strength

Discover the difference of a boutique financial advisory firm that combines high-touch service with the resources of Fortune 500 institutions. Get personalized advice, feel understood, and gain confidence in your financial future.

An Investing Framework That Actually Fits Real Life

Wealth lasts longer when investing decisions are built around time, flexibility, and real life change rather than market noise

Legacy and Impact

Legacy is not about what you leave behind. It is about intention, clarity, and the quiet impact your wealth has on people and choices over time.

Outliving Your Money Is Not a Spending Problem

Outliving your money is rarely caused by overspending. It is usually the result of planning that underestimates longevity, income structure, and how life changes over time.

When Saving Feels Safer Than Spending: The Hidden Psychology of Retirement

After decades of saving, many retirees struggle more with mindset than math. Fear of running out of money can make spending feel risky. We guide retirees to align financial planning with purpose, reframe spending anxieties, and fund a life well-lived.

Share Your Most Precious Gift: Time

True wealth isn’t flashy cars or luxury gifts. This holiday season, the most meaningful present you can give yourself isn’t under the tree, it’s time.

Learn how quiet, intentional financial habits create freedom, choice, and peace that last a lifetime.

The Hidden Risk That Can Derail Your Retirement

The “sequence of returns” is one of retirement’s most misunderstood risks.

Learn how to build a strategy that helps your wealth and freedom last

Roth Conversions: The Tax You Pay Today To Own Your Future

Discovery how a Roth Conversion can help you. Retirement isn’t an ending. It’s a reinvention. It’s your moment to redesign life with purpose, energy, and intentional direction.

Why We Really Procrastinate

Feeling stuck in “I’ll start tomorrow”? Procrastination isn’t a time problem, it’s emotional. Fear, overwhelm, or the pressure to be perfect keeps us frozen. By starting small, connecting tasks to purpose, removing distractions, letting go of perfection, and rewarding action, you can reclaim your energy, build momentum, and create a longer, more purposeful life.

Wealthspan and Purpose: The Blueprint for a Confident Life

Retirement isn’t a finish line, it’s a launchpad. Wealthspan helps your money, health, and purpose align so you can live decades of freedom.

The 5 Non-Financial Risks to Your Longevity Plan

Wealth alone won’t secure your future. Explore the five non-financial risks that can shrink your freedom and learn how to protect your wealthspan.

The $400,000 Gap Nobody Talks About: Healthcare Costs in Retirement

The average American will spend over $400,000 on healthcare in retirement, yet most people never budget for it. The question isn't whether you'll face these costs. It's whether you'll be ready when they arrive.

Your Wealth Has a Lifespan: 7 Steps to Make It Last

Your wealth has a lifespan. This 7-step roadmap shows you how to make it last as long as you do, building clarity, resilience, and freedom at every stage.

Your Wealthspan, Explained: Why Retirement Is Just the Beginning

Retirement isn’t an end, it’s a launch.

Discover how Wealthspan helps your money, health, and freedom align for a confident future

Your Purpose After Work. Live Fully.

For decades, retirement has been defined by a simple script: work, save, and then stop. The happiest, longest-living people don't just stop working; they replace work with meaningful activities. They have a "reason for being."

10 Smart Strategies for a Longer Wealthspan

Imagine it's a Saturday morning 25 years from now. Your coffee is hot, your calendar is empty, and your money is working harder than you are.