Resources for Smart Financial Planning

The Right Tools for the Right Conversation

Planning a thirty year or longer retirement is not about spreadsheets.

It is about clarity.

Confidence.

Control.

At Longevity Wealth Strategies, we use purpose driven tools at each stage of the Wealthspan journey to support better decisions with less stress. These tools are selected not for their complexity, but for their ability to make important tradeoffs visible and understandable.

Tools That Turn Clarity Into Action

These tools are not just visual aids.

They create common ground for meaningful conversations and accelerate confidence, especially in volatile or uncertain conditions.

When you can clearly see how decisions interact, conversations become calmer, tradeoffs become clearer, and next steps feel intentional rather than reactive.

Why Tools Matter in Wealthspan Planning

Most financial stress does not come from lack of information.

It comes from fragmented information.

Accounts viewed in isolation.

Risk discussed separately from income.

Taxes considered after decisions are already made.

The tools we use are designed to bring the full picture together so decisions can be evaluated in context and over time.

When you see your financial world clearly, decisions stop being guesses and start being strategy.

Coordinating Decisions Across Time

No single decision exists in isolation.

The tools we use help evaluate how decisions around investments, taxes, risk, and legacy interact over time so adjustments can be made intentionally rather than reactively.

This coordination is essential to building a durable Wealthspan.

Where These Tools Come Together

Tools alone do not create clarity.

Conversation does.

That is why these tools are introduced within the context of the Wealthspan Review, where they are used to support understanding rather than overwhelm.

Tools for Your Wealthspan Journey™

-

What's Your Risk

Know Your Risk. Align With Your Life.

"Investing shouldn’t feel like guessing — it should feel like a fit."

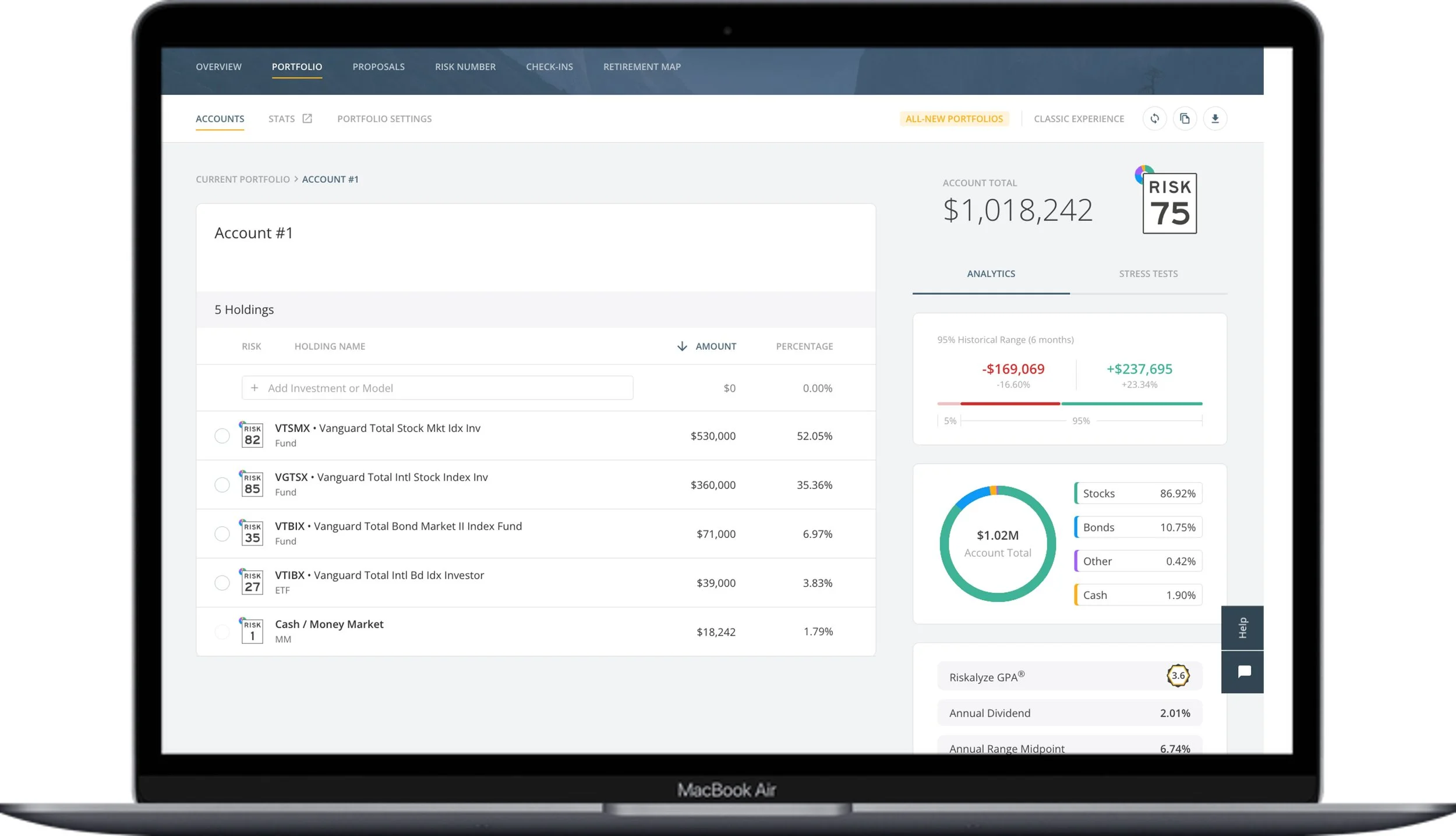

At Longevity Wealth Strategies, we use Nitrogen® (formerly Riskalyze) to help you understand how much investment risk is right for you — and whether your current portfolio supports that level with confidence and clarity.

Because when your strategy fits your Wealthspan™, you can stay grounded through every market cycle.

How Nitrogen Helps You Stay in Control

Watch the short video below to see how Nitrogen works — then take the same assessment we use in our Wealthspan Review™ process.

Key Benefits:

Discover Your Risk Number®

Take a quick, interactive assessment to identify your personal risk tolerance — based on logic, not emotion.Match Your Portfolio to Your Profile

See whether your current investments align with your Risk Number® — and spot potential over- or under-exposure.Stress-Test for Real-World Events

Understand how your portfolio might respond to different market scenarios — before they happen.Stay on Track as Life Evolves

Your Wealthspan will change. Nitrogen helps you adapt your strategy with it.Why It Matters to Your Wealthspan™

Risk is more than a number — it’s about protecting your confidence, clarity, and control throughout your retirement journey.

A well-matched investment strategy:

Helps you avoid emotional decisions during volatility

Keeps you committed to your long-term plan

Supports sustainable retirement income

Confidence doesn’t come from guessing — it comes from knowing.

Where It Fits in Your Journey

We use Nitrogen early in your Wealthspan Review™ to assess risk alignment before making any recommendations.

It’s a key step in building a strategy that truly fits your life. -

Visualize Your Assets

Clarity leads to confidence. That starts with seeing everything clearly.

At Longevity Wealth Strategies, we use Asset-Map® to give you a clear, visual snapshot of your entire financial life — so you can make better decisions faster and with greater confidence.

This one-page view brings order to complexity and helps ensure your financial strategy supports your Wealthspan goals at every stage.

What Asset-Map Helps You Do

Visualize Your Entire Financial Life

Assets, liabilities, income streams, insurance, and legal docs — all mapped in one intuitive, easy-to-read layout.Spot Gaps Before They Become Problems

Quickly identify risks like missing coverage, funding shortfalls, or misaligned strategies.See the Big Picture Without Losing the Details

Stay focused on what matters most while tracking key milestones and progress toward goals.Make Decisions With Confidence

Use your Asset-Map in every strategy conversation to evaluate choices through a clear, personalized lens.Collaborate With Clarity

We use this tool in every review meeting so you always know where you stand and what needs attention next.Why It Matters to Your Wealthspan

Retirement planning isn’t just about projections, it’s about knowing where you stand today and whether your financial life is organized to support the decades ahead.

Asset-Map gives you that clarity so you can move forward with confidence, direction, and control.

Where It Fits in Your Journey

Asset-Map is created early in your Wealthspan Review™, providing a shared foundation for all future planning. It’s often the “aha” moment that helps clients finally see their full financial picture.

-

Smart Dashboard

See Your Plan. Stay on Track.

Confidence in retirement starts with clarity and that means knowing where you stand, anytime, anywhere.

As part of every planning relationship, we provide secure access to your Smart Dashboard, powered by WealthVision® (eMoney). It’s your personal financial command center built to help you organize, track, and engage with your Wealthspan strategy in real time.

How the Smart Dashboard Supports Your Journey

See Everything in One Place

View all your accounts, assets, income, and planning documents from a single, easy-to-navigate dashboard.Stay on Track Toward Your Goals

Track progress toward retirement, lifestyle, or legacy goals and always know where you stand.Explore “What-If” Scenarios

Model future decisions before making them. Understand how career changes, purchases, or early retirement may impact your plan.Collaborate Easily and Securely

Share documents, upload updates, and message your advisor in a secure, encrypted environment.Organize Your Financial Life

Use your digital vault to store legal docs, tax returns, estate plans, and more, all in one secure place.Why It Matters to Your Wealthspan

Long-term planning only works if you stay engaged with it. The Smart Dashboard keeps you connected to your strategy so you can make decisions confidently, track your progress, and ensure your wealth supports the life you’re living.

Where It Fits in Your Journey

You’ll gain access to the Smart Dashboard after your Wealthspan Review™, once we begin building your personalized roadmap. It becomes the central hub for your evolving financial life.