What is Wealthspan?

Wealthspan is the financial counterpart to lifespan and healthspan.

It’s the length of time your financial resources can support your life choices with flexibility as circumstances change.

In financial planning terms, Wealthspan describes how income, assets, and financial decisions are structured to remain sustainable across decades rather than at a single moment.

It is a way of evaluating whether your financial system continues to work as life unfolds.

What Wealthspan Is Not

Wealthspan is not net worth.

It is not retirement income.

It is not a finish line.

Those measures capture snapshots.

Wealthspan focuses on durability over time.

How Wealthspan Changes the Questions

Most traditional planning focuses on reaching a number or an age.

Wealthspan focuses on whether your financial system continues to work over time and through change.

When you think this way, the questions change.

Instead of asking whether you are on track,

You begin asking whether your system is resilient,

How adaptable it is to changing conditions,

and what happens when life evolves again.

Lifespan, Healthspan, and Wealthspan

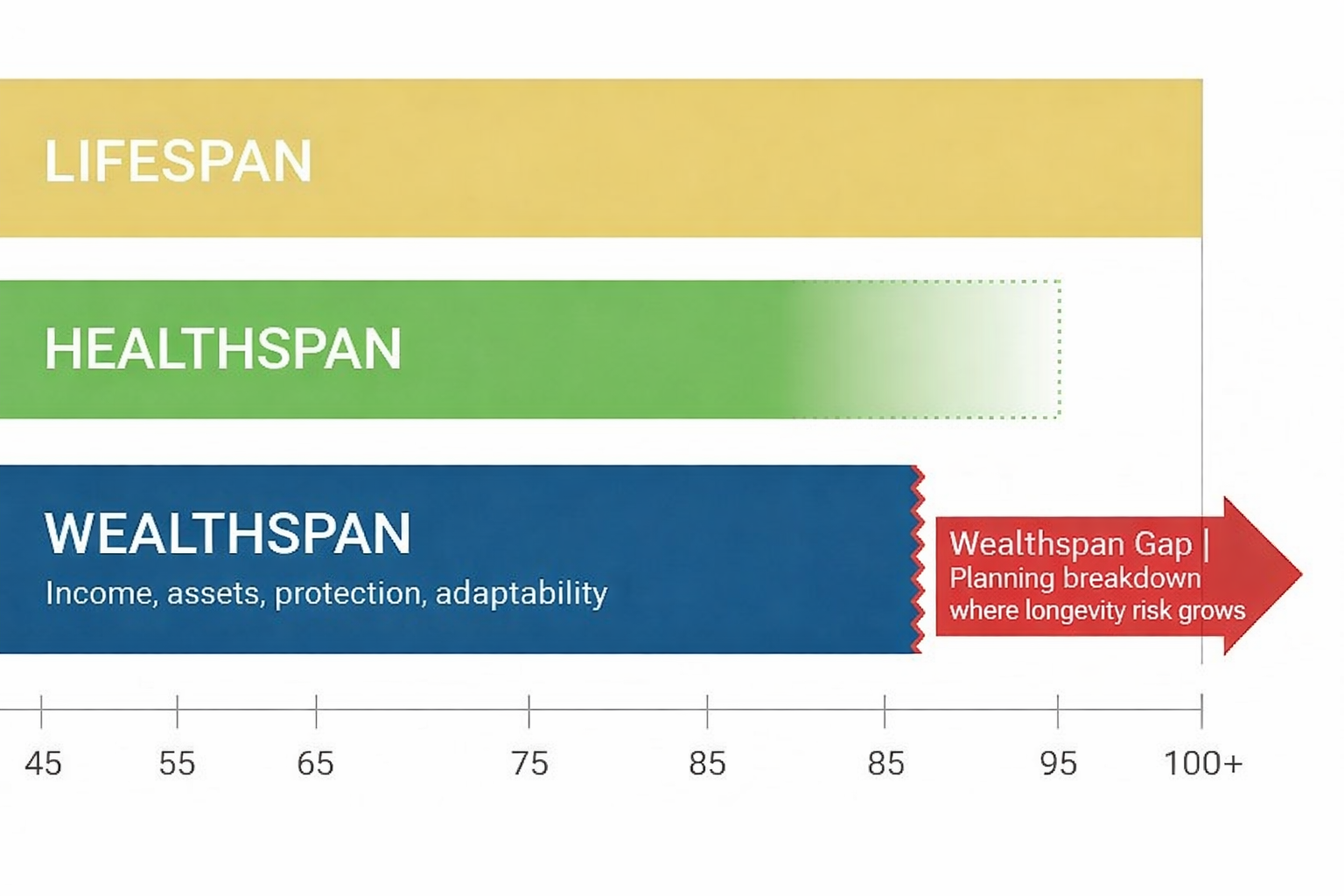

Lifespan, Healthspan, and Wealthspan describe different but connected dimensions of a long life.

Lifespan reflects how long you live.

Healthspan reflects how long you live well.

Wealthspan reflects how long your financial system supports your choices with flexibility and confidence.

They are related, but they are not interchangeable.

Wealthspan supports lifespan and healthspan by providing financial flexibility over time.

The Wealthspan Gap

Many plans appear sound on paper.

They assume steady income.

They project consistent returns.

They expect predictability.

The real risk emerges when life does not follow a straight line.

The Wealthspan Gap is the distance between how long a financial system holds up and how long life demands flexibility.

That gap often widens quietly before it becomes visible.

Why Traditional Planning Breaks Down

Retirement rarely fails because people do not save enough.

It fails when planning assumes life will remain predictable and decisions will not need to adapt.

As time horizons lengthen, small misalignments compound.

Flexibility matters more.

Sequence matters more.

Coordination matters more.

Wealthspan exists to account for those realities.

How Wealthspan Is Used

Wealthspan is not a product or a model.

It is a lens for evaluating decisions around income, risk, taxes, and timing across longer horizons.

This perspective helps reveal how decisions interact, where pressure may build, and what deserves attention before change forces action.

Where Wealthspan Begins

Wealthspan does not begin with recommendations.

It begins with clarity.

Understanding how your financial life behaves today is the foundation for deciding what matters next.

That is why every planning relationship begins with the Wealthspan Review™ - a structured conversation designed to reveal how your financial system holds up over time.

A Different Way of Evaluating Planning

Wealthspan is not a better version of traditional retirement planning.

It is a different way of evaluating whether a financial system continues to work as life, markets, and priorities change.

For people thinking in longer horizons, this perspective provides structure, confidence, and direction.

Begin With a Wealthspan Review™

A focused conversation about how your financial system behaves over time and what deserves attention next.

Request a Wealthspan Review™Request a Wealthspan Review.

For most families, the risk is not living longer or living well. The risk is that money stops adapting before life does.

FAQs About What is Wealthspan?

-

No.

Retirement planning typically focuses on when work ends. Wealthspan focuses on how long life continues and whether your money can support it with confidence, flexibility, and clarity.

-

Wealthspan is not defined by a number.

It is defined by alignment between income, lifestyle, risk, and longevity. People with significant assets can still experience a short Wealthspan if planning is incomplete.

-

No.

Investments matter, but Wealthspan is shaped just as much by income strategy, taxes, healthcare planning, and adaptability over time.

-

Financial independence emphasizes optional work. Wealthspan emphasizes optional living, confidence that your financial decisions will support your life for as long as it unfolds.

-

The earlier clarity begins, the more options exist.

Most of our clients begin thinking seriously about Wealthspan within 5 to 10 years of retirement, but the concept applies well before and well after that transition.

Your Next Step

Wealthspan clarity begins with understanding how your financial system holds up over time. The question is not whether to act today, but whether greater clarity would change how confidently you make decisions.

Explore the Wealthspan Review™A structured clarity conversation designed for people navigating real life financial decisions. This is a place to orient, not decide.

Requests are reviewed to ensure fit. No pressure. Just clarity before decisions are made.