Tech Meets Humanity: How FinTech Tools Empower Better Outcomes

Image by Jan van der Wolf

Estimated Reading Time 5 Minutes

Technology isn’t replacing advisors. It’s amplifying them.

FinTech tools like Asset-Map, WelthVision, and Nitrogen don’t remove the human element, they give it superpowers.

When clarity meets empathy, clients make smarter decisions and live freer lives. That’s the real promise of wealthspan.

Why do we still crave human connection in a digital world?

We live in an age of apps, dashboards, and instant answers.

You can track your steps, sleep, investments, even your mood.

And yet,

when it comes to money, most people still want to talk to someone they trust.

Not a chatbot. Not a dashboard. A human.

Because money isn’t just math.

It’s emotion. It’s identity. It’s the story of who we are and what we hope to become.

That’s why technology alone can’t create confidence.

But technology with humanity? That’s where transformation happens.

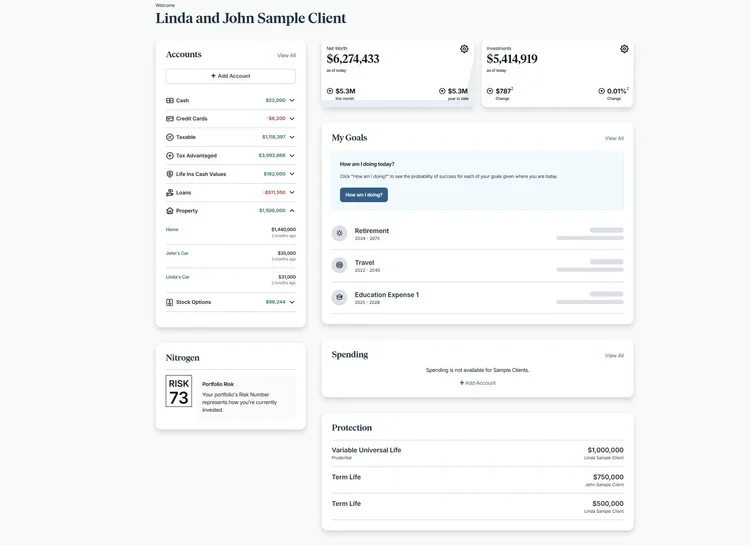

Sample Wealth Vision Dashboard

What happens when technology amplifies human wisdom?

The best FinTech doesn’t replace advice, it reveals it.

Think of it like turning on the lights in a room you’ve been walking through in the dark.

Tools like Asset-Map, WealthVision, and Nitrogen don’t just crunch numbers.

They create clarity. They show patterns, risks, and opportunities that might otherwise hide in the fine print.

Asset-Map paints a living, visual snapshot of your financial life. One glance and you can see everything that matters—what’s strong, what’s missing, and what’s possible.

WealthVision connects your entire financial ecosystem. It turns data into a daily awareness of progress, tracking, budgeting, and planning all in one view.

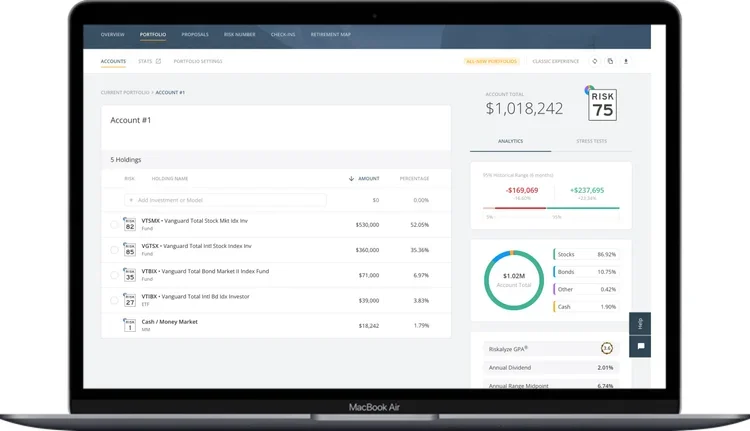

Nitrogen (formerly Riskalyze) helps align your comfort with your portfolio’s behavior making sure your investments feel like you.

Each of these tools solves a different problem.

Together, they create a clearer picture of your wealth and your choices.

Sample Risk Comfort Level

How does technology create trust instead of replacing it?

Trust doesn’t come from numbers on a screen.

It comes from seeing yourself clearly and knowing someone else truly sees you too.

That’s where Longevity Wealth Strategies comes in.

We use technology to bring your financial life into focus, then we use conversation to bring meaning to what we see.

FinTech makes it visible.

We make it personal.

Because when you can see your entire financial landscape at once, you stop feeling lost in the details.

You stop reacting. You start deciding.

That’s what trust feels like: clarity replacing confusion.

Sample Asset Map

What’s the real benefit? Time.

Here’s the truth: FinTech isn’t really about technology.

It’s about time.

By automating the complex, it gives you back the most valuable asset of all, your attention.

Advisors spend less time tracking data and more time guiding decisions.

Clients spend less time worrying and more time living.

That’s the FinTech dividend: more time for what matters most.

Can technology actually improve behavior?

Yes, but only when it’s paired with accountability.

Behavioral finance research consistently shows that people make better decisions when they can see progress in real time.

That’s why dashboards and visuals aren’t gimmicks, they’re feedback loops.

When you see your retirement readiness grow or your debt shrink, you feel the impact.

That sense of momentum changes everything.

Technology gives you data.

But when combined with a Longevity Strategist, it becomes direction.

We don’t just show you where you stand.

We help you take the next step with purpose and confidence.

What does “Tech Meets Humanity” look like in practice?

It looks like this:

A client logs into their WealthVision dashboard on a Sunday morning and sees their “Wealthspan Tracker” in green. They text their strategist, not with anxiety, but excitement.

Next week, they meet virtually to explore how a small change in savings could help them fund that trip they’ve been dreaming of.

That’s not a spreadsheet moment.

That’s a life moment.

Technology made it possible.

Humanity made it meaningful.

Why it matters for your Wealthspan

Wealthspan isn’t just about how long your money lasts.

It’s about how long your freedom does.

FinTech gives us the tools to design smarter, faster, more resilient plans.

But wisdom, the kind that weaves those plans into a life well-lived, still comes from human conversation.

At Longevity Wealth Strategies, we believe the future of financial freedom is hybrid.

Digital where it’s efficient.

Human where it’s essential.

Because the ultimate goal isn’t to have the best software.

It’s to live with clarity, confidence and choice with wealth that truly lasts.

Write your next chapter.

Technology has changed how we plan.

But it hasn’t changed why we plan.

We plan for freedom. For time. For legacy.

FinTech gives us the tools.

You give it purpose.

Start your next chapter today.

Schedule your Wealthspan Review today and see how where your stand today.

Your Next Step

The Wealthspan Review is a simple, no-pressure conversation designed to help you understand where you stand today and whether our approach fits what you are trying to build.

Request a Wealthspan Review™Disclaimer: The information provided is for educational purposes only and does not constitute investment, tax, or financial advice. Consult with a licensed professional before making financial decisions.