Resources

for

Smart Financial Planning

Explore tools, insights, and guides to help you make informed decisions and take control of your financial future.

-

Smart Dashboard

Your Personal Financial Dashboard

As part of our commitment to delivering clarity and confidence, we provide every client with access to their own personal financial dashboard powered by WealthVision—a powerful, secure platform that brings your entire financial picture into focus.

With your WealthVision portal, you can:

See Everything in One Place: All your accounts, assets, and financial data in a single, easy-to-use dashboard

Track Your Progress: Monitor your goals and stay on top of your financial plan

Explore “What If” Scenarios: Understand the long-term impact of major life decisions

Collaborate Securely: Share documents, updates, and messages with us in real time

Stay Organized: Store important financial documents in one secure digital vault

eMoney empowers you to make smarter decisions and stay connected to your plan—anytime, anywhere.

-

Visualize Your Assets

Asset-Map: Your Financial Life—Simplified and Visualized

We use Asset-Map to give you a clear, one-page snapshot of your entire financial life. This powerful tool makes it easy to understand where you stand, identify gaps, and stay focused on what matters most.

With Asset-Map, you can:

Visualize Your Finances: See all your assets, liabilities, income, and insurance in one intuitive visual

Spot Gaps Quickly: Identify areas that may need attention—like missing coverage or underfunded goals

Stay Focused: Keep the big picture in view while working toward specific goals

Make Confident Decisions: Use your Asset-Map as a guide in every major financial conversation

Collaborate Clearly: We use this tool in every review meeting to ensure we're aligned and on track

Asset-Map turns complex financial information into a clear, actionable picture—helping you make smarter, faster decisions with confidence.

-

What's Your Risk

Know Your Risk

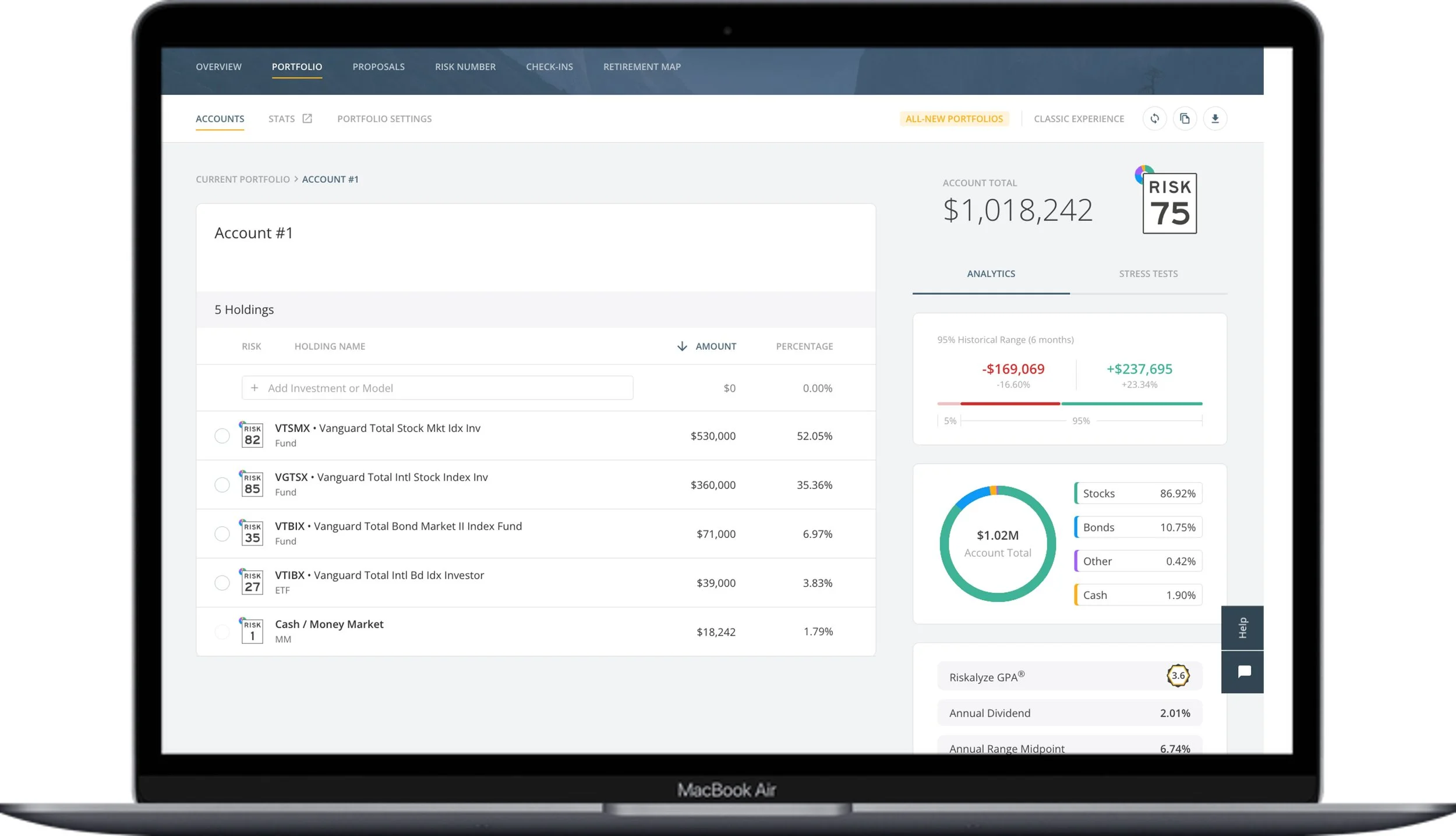

How much risk is right for you—and are you actually taking it?

At Longevity Wealth Strategies, we use Nitrogen to help you understand your personal risk tolerance and align it with your investment strategy. It's a simple, science-backed way to ensure your portfolio truly fits you.

With Nitrogen, you can:

Discover Your Risk Number®: Take a short, interactive questionnaire to identify your comfort level with investment risk

Align Your Portfolio: See how your current investments stack up against your Risk Number®

Plan with Confidence: Understand potential ups and downs before they happen, and stress-test your portfolio for real-world scenarios

Stay on Track: Adjust your strategy over time to reflect changes in your goals, timeline, or market conditions

Knowing your risk helps you avoid emotional decisions, stay invested with confidence, and build a plan that truly fits your life.